About Us

Syndicate Management

Investing at Lloyd's

tax-corporate-services

News

Investing in syndicates entails providing capital to support their underwriting. You can provide this capital by pledging existing investments as security, thus enabling them to work harder.

The ups and downs of re/insurance pricing – and thus profitability – have some drivers that are not directly linked to the economy, such as the occurrence of natural disasters, war, shipping accidents, etc. This allows you to diversify your investment portfolio.

The Lloyd’s market is renowned for the range of insurance lines it writes globally as well as its ability to innovate in terms of coverage and distribution. Investing in syndicates allows an insurer to harness the economic opportunities of product lines or regions that it doesn’t already write without the investment and execution risk required to enter the market itself. There is scope to move beyond an investment relationship with syndicates and consider a knowledge-sharing partnership or product development initiatives.

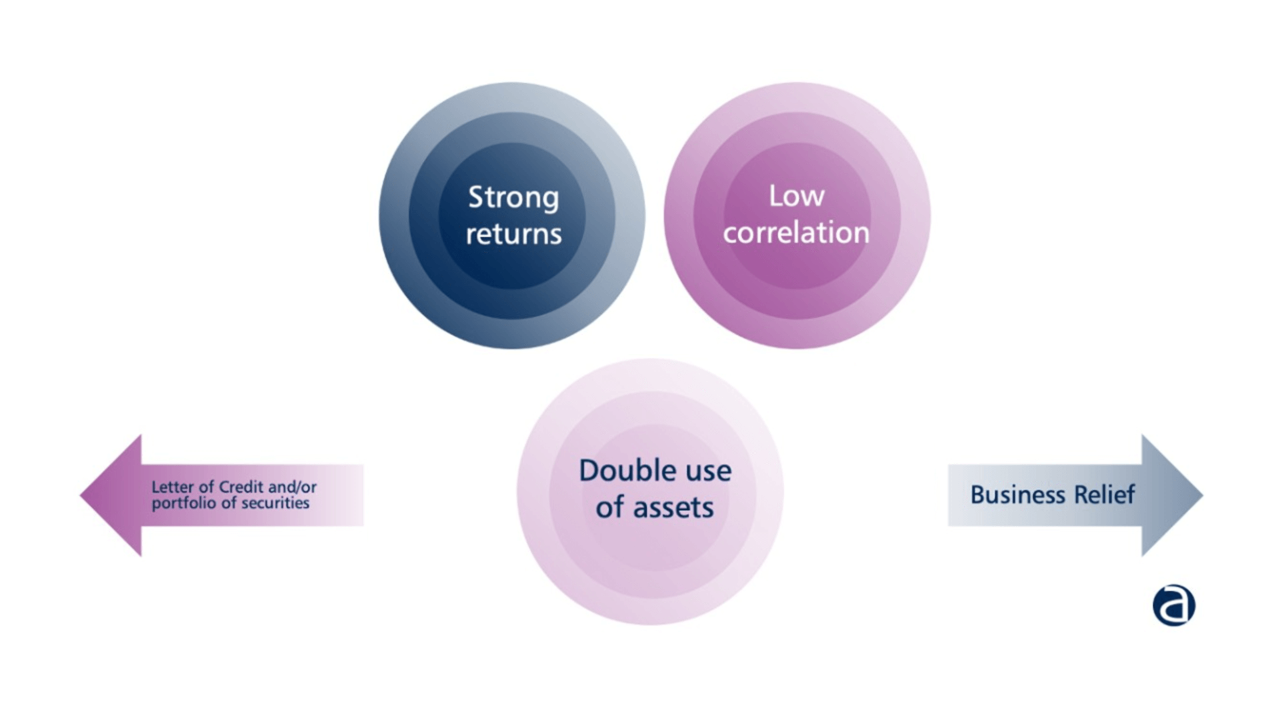

There are three key benefits to investing at Lloyd’s.

Returns on capital will vary according to the level of diversification and risk in a portfolio. However, Argenta’s clients have enjoyed a successful run of results – including average annualised returns for investors in excess of 10% over the last 14 years to 2022.

Lloyd’s investments exhibit a low correlation with other more traditional assets and therefore can provide valuable diversification for investors seeking to spread risk amongst alternative asset classes.

Another of the significant attractions to underwriting at Lloyd’s is the potential to use certain investment assets twice. The collateral to support underwriting does not have to be paid up in advance in cash but can be provided via a bank guarantee or letter of credit secured on a portion of an existing investment portfolio. For example, this can enable investors to retain income and gains on a portfolio of property outside of their principal private residence whilst also benefiting from insurance returns from Lloyd’s. When used in a qualifying trade such as Lloyd’s, the same assets may also benefit from Business Relief for Inheritance Tax purposes, making Lloyd’s vehicles an interesting estate planning consideration.

Core assets: Cash, government bonds, IG corporate funds, bond funds

Non-core assets: Sub-IG corporate bonds, government bonds, bond funds, equities, equity funds and VCTs

Other: Letters of Credit and guarantees

Lloyd’s syndicates have to hold capital in trust in order to underwrite. This is to protect policyholders in the event that claims and expenses exceed premiums received. This capital can be provided in full by their parent company, or it can be provided in part by investors. In exchange for contributing capital, investors receive a share of the syndicate result.

Generally, diversifying your portfolio across a number of syndicates improves your return on capital via diversification credit, though syndicate selection is critical. It is not possible to pick individual lines of business, sectors or jurisdictions that you want to include, just syndicates. Argenta can help you manage your business mix by choosing syndicates that write your in-appetite segments or avoid the out-of-appetite ones.

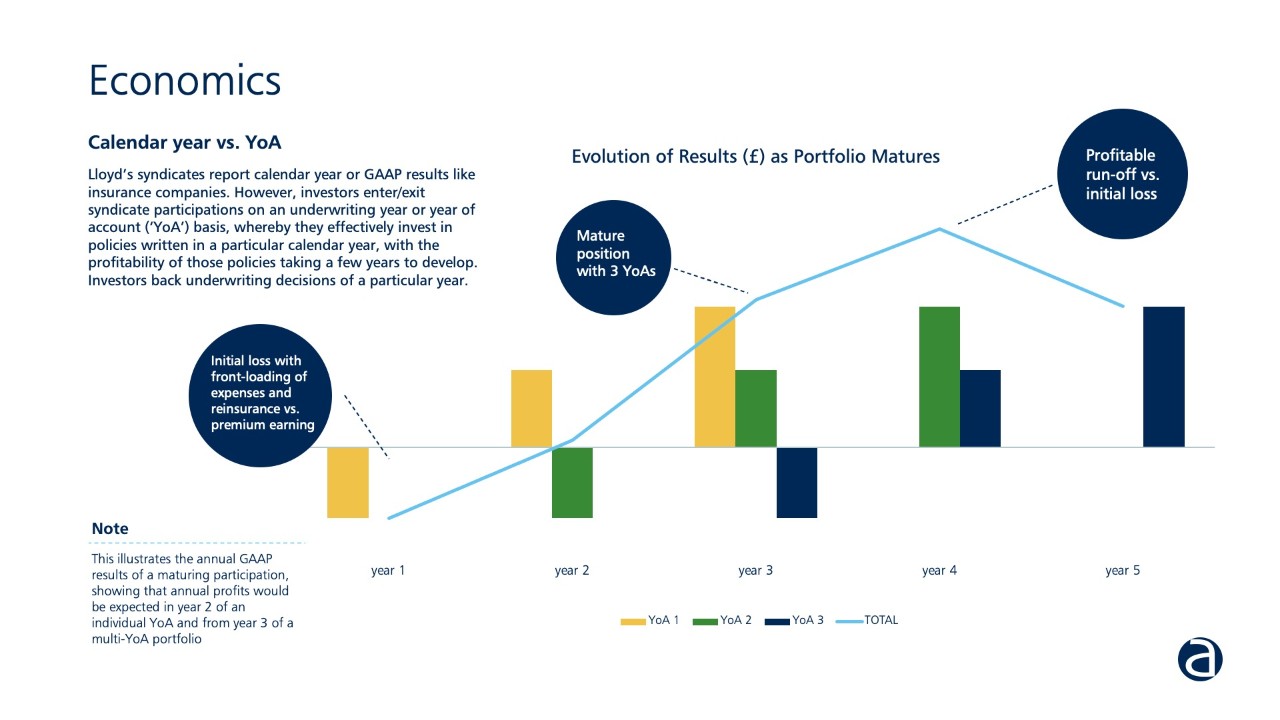

You should view investing at Lloyd’s as a medium- to long-term strategy. Typically, capital is tied up for several years and you should expect to see paper losses in the first one or two years before a realised profit from year three.

We can advise you on the appropriate structure for your investment as well as the portfolio of syndicates that would fit your appetite. We will manage the Lloyd’s application process, establish the necessary corporate vehicles, prepare accounts and provide company secretarial services.

There are a number of routes available, enabling us to create a structure that works for you. There is usually a six to nine month lead-in time from initial interest to putting your money to work.