About Us

Syndicate Management

Investing at Lloyd's

tax-corporate-services

News

Argenta Private Capital Limited (APCL) offers private clients a wide variety of ways to invest in the Lloyd’s of London insurance market.

Interested in investing? We specialise in creating tailor-made, tax-efficient underwriting vehicles for a worldwide client base that currently supports £5.1bn gross written premium into the Lloyd’s market. With our origins dating back to 1962, we have been consistently at the forefront of innovation in the Lloyd’s market, launching a number of new limited liability vehicles in the last five years.

Our experience

We have unrivalled experience of operating and advising within the Lloyd’s market – our client team has more than 250 years of experience at Lloyd’s. Our experience and track record enables us to create the best possible return on capital for clients at the lowest level of capital risk.

Our performance

We aim to deliver smooth, long-term returns for clients, targeting optimum results for a lower risk on capital deployed. APCL has enjoyed a successful run of results including average annualised returns for investors in excess of 10% over a 16 year period, with 2025 forecast to produce returns in excess of 20%.

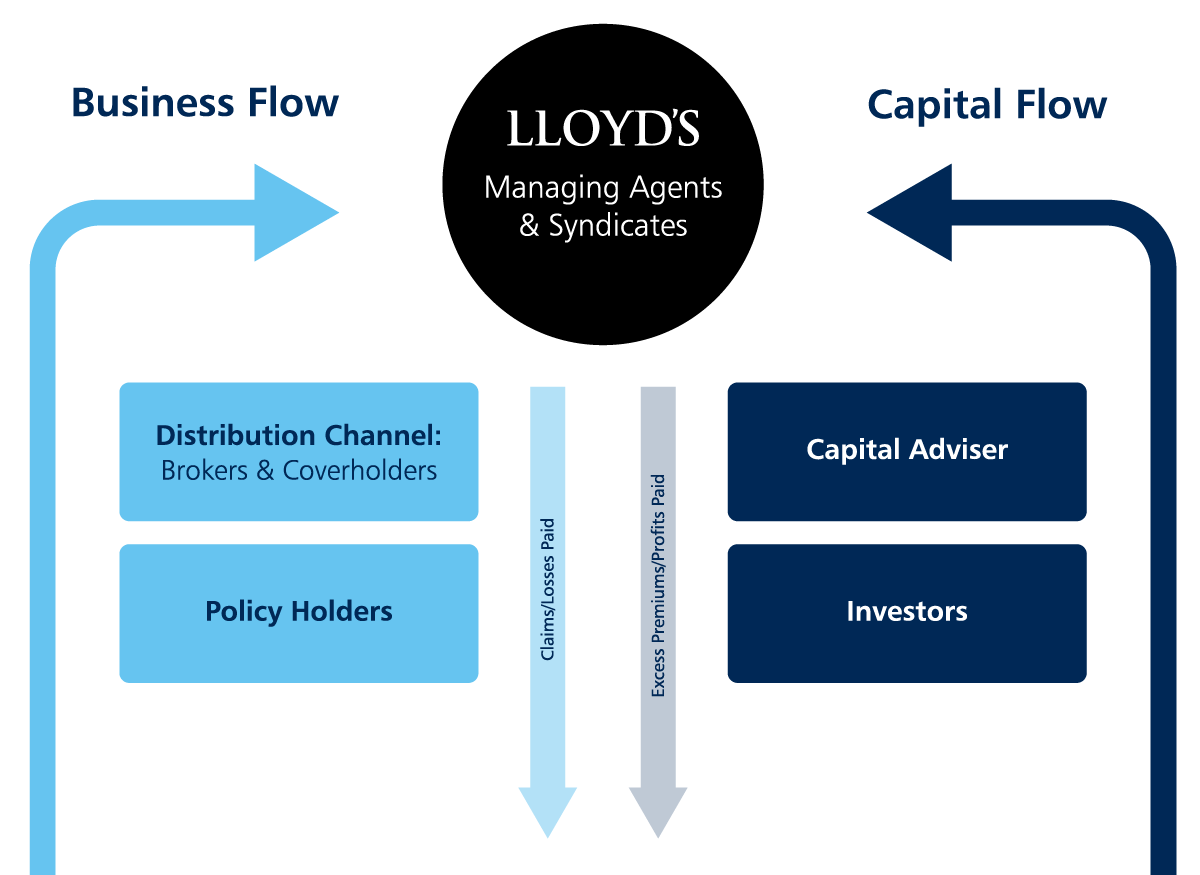

The Lloyd's market is made up of managing agents and syndicates. Investors provide capital for these organisations to write insurance across a wide range of different business lines and asset classes, typically in hard-to-place, innovative lines of business.

When a syndicate writes insurance business, it receives premiums from – and pays out claims to – policyholders. In successful years, premiums will exceed claims and expenses, allowing syndicates to generate an underwriting profit. In unsuccessful years, claims and expenses may exceed premiums, leading to syndicates generating an underwriting loss.

Investors at (or members of) Lloyd’s collectively pledge capital to syndicates, which are separately managed to underwrite on their behalf. Each managing agent employs a team of underwriters on the syndicates to accept a portfolio of diverse insurance policies across different lines of business. After three years, a result is declared for policies written by syndicates and this is shared among the supporting capital providers in proportion to their commitment.

These transactions are underpinned by the robust capital structure in place which guarantees the policyholders/customers that the capital is available to pay valid claims when required. This capital adequacy is assessed annually by a number of rating agencies who reconfirm Lloyd’s secure ratings. These are:

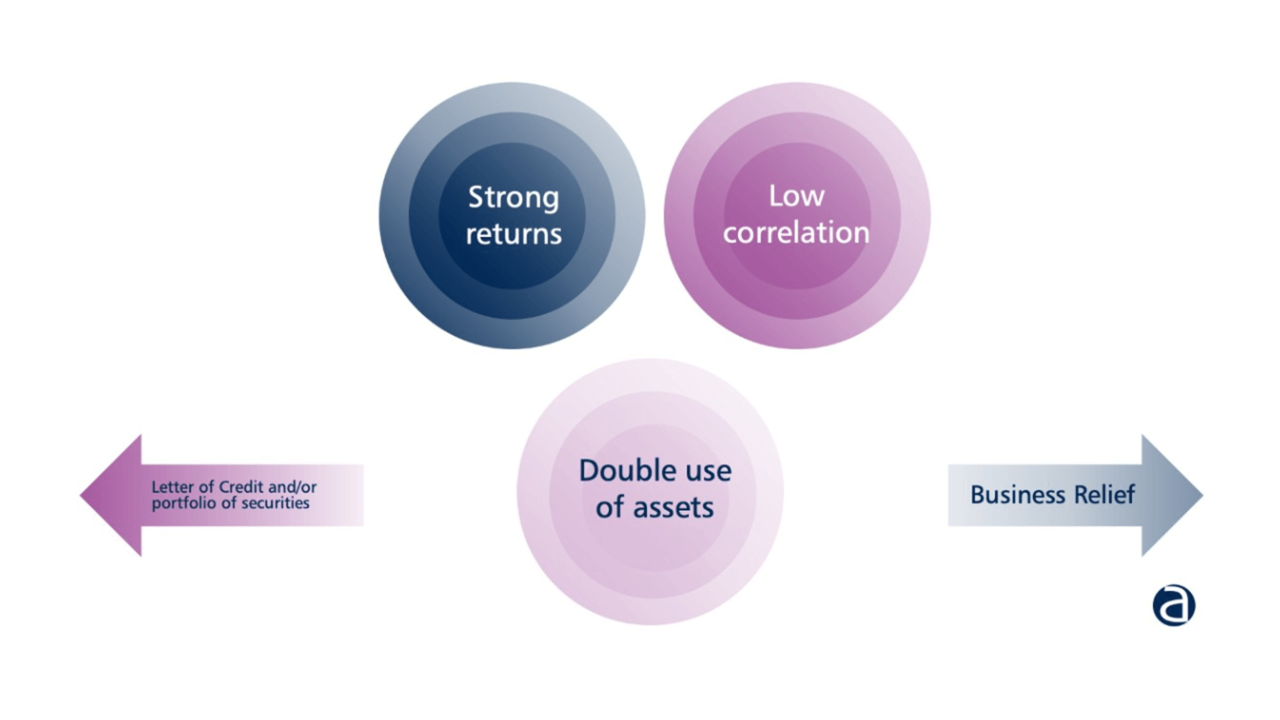

There are four key benefits to investing at Lloyd’s.

Returns on capital will vary according to the level of diversification and risk in a portfolio, however Argenta’s clients have enjoyed a successful run of results – including average annualised returns for investors in excess of 10% over the last 16 years to 2024.

Lloyd’s investments exhibit a low correlation with other more traditional assets and therefore can provide valuable diversification for investors seeking to spread risk amongst alternative asset classes.

An investment at Lloyd’s qualifies for Business Relief and therefore clients can pass on their Lloyd’s assets to their heirs free of Inheritance Tax.

Another of the significant attractions to underwriting at Lloyd’s is the potential to use certain investment assets twice. The collateral to support underwriting does not have to be paid up in advance in cash but can be provided via a bank guarantee or letter of credit secured on a portion of an existing investment portfolio. For example, this can enable investors to retain income and gains on a portfolio of property outside of their principal private residence whilst also benefiting from insurance returns from Lloyd’s. When used in a qualifying trade such as Lloyd’s, the same assets may also benefit from Business Relief for Inheritance Tax purposes, making Lloyd’s vehicles an interesting estate planning consideration.

Core assets: Cash, government bonds, IG corporate funds, bond funds

Non-core assets: Sub-IG corporate bonds, government bonds, bond funds, equities, equity funds and VCTs

Other: Letters of Credit and guarantees

Our clients are high-net-worth and ultra-high-net-worth individuals, some of whom have been with us for many years. Our clients range in background and experience. In recent years we have seen an increase in professionals investing in Lloyd’s, alive to the benefits of investing at Lloyd’s and who have been introduced to us by their bankers, wealth managers and advisors.

The risk appetite of each investor is likely to vary. Argenta offers a number of different investment options, however investors should be aware that returns can be significant but at times can also be volatile due to the nature of the market.

Investing into the Lloyd’s market should be viewed as a long term investment. It is therefore recommended that investments should be a minimum of 5 years. Investors should appreciate that benefits are typically drawn over a longer period of time due to the cyclical nature of the insurance market and Lloyd’s.

Typically an investor should be looking to commit a minimum £1m at Lloyd’s which may be a combination of cash and already owned assets and this should not represent more the 10% of an investor’s overall net wealth. Of this 10%, Argenta advises that the investment amount is diversified across a number of syndicates. Investors should be able to respond to events such as a call to pay claims for an insured loss. If significant, investors may be asked to increase their collateral at short notice. Investors should have access to sufficient liquid assets to accommodate this possibility.

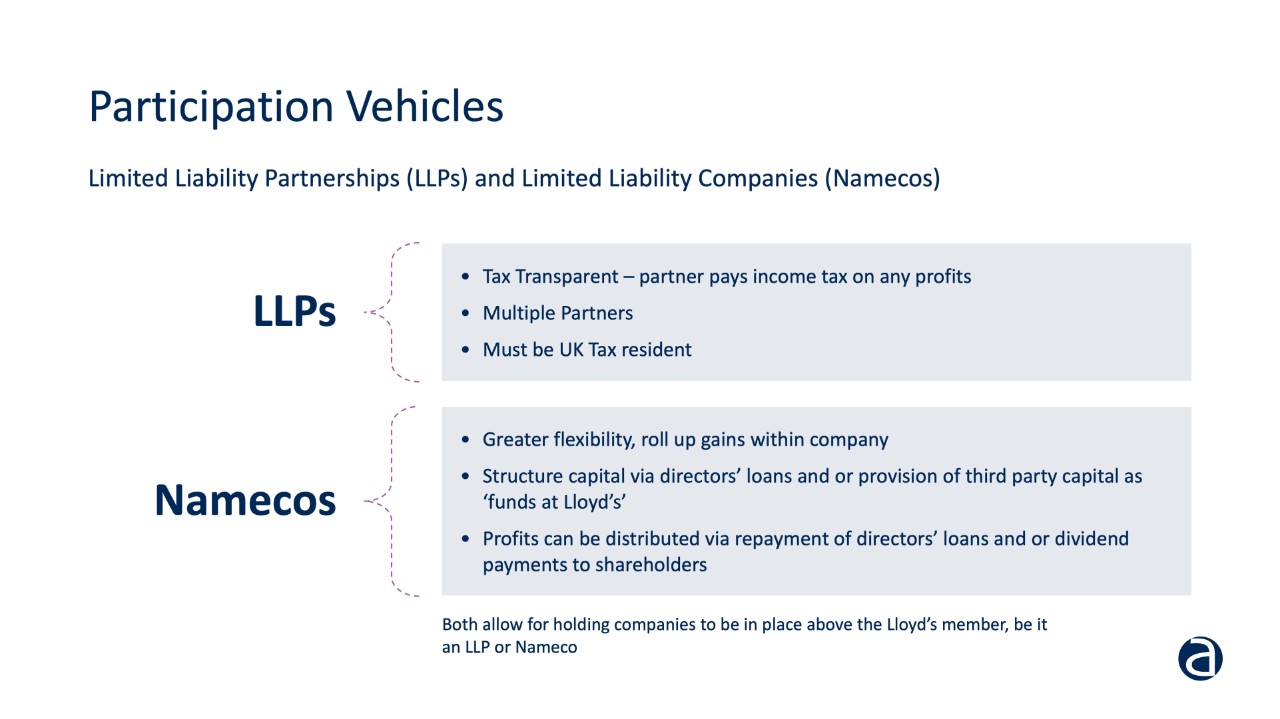

All but the largest corporate Lloyd’s investors (members) appoint a specialist insurance investment adviser, like APCL - known as a Members’ Agent - to structure and manage a Lloyd’s investment vehicle. Often together with an investor’s accountant or tax adviser, we help choose an appropriate structure for the investment (typically a choice between a limited company or limited partnership) and guide the investor through the application process.

With our assistance, the investor will select an appropriate portfolio of insurance syndicates and pledge capital to them, with each one being separately managed to underwrite on their behalf. Each managing agent employs a team of underwriters on the syndicates to accept a portfolio of diverse insurance policies across different lines of business. Our research team will then monitor those syndicates once the investment has commenced. After three years from the start of a policy, if the total of claims and expenses are less than premiums, a profit is declared and shared among the supporting capital providers.

Investors may elect to underwrite a managed portfolio of syndicates chosen by us, based on recommendations from our research team, or choose a 'bespoke' portfolio tailored to suit individual risk/reward objectives.

To participate in syndicates at Lloyd’s, investors must secure underwriting capacity. Put simply, underwriting capacity is used to measure the share of the syndicate result to which the investor is entitled, based on their capacity compared to the total capacity of the syndicate. There are several ways to acquire capacity. One is to enter the annual auctions, held in each autumn for the following year’s underwriting. Prospective participations on syndicates are bought and sold by investors via a matched bargain process. Another way is via limited tenancy agreements on syndicates, where the investor takes a share for one or more years without evergreen participation rights. Argenta will guide you through these alternatives, giving you flexibility to design a portfolio of underwriting that meets your investment goals and is your risk appetite.